The only stablecoin ecosystem you will ever need. And use.

Interact directly with the Frankencoin ecosystem smart contract from your self-custody Wallet and use the only real-decentralized, collateralized and oracle-free stablecoin tracking the value of the most stable Fiat currency worldwide - the Swiss franc.

Based in Switzerland

What is the Frankencoin? And what you can do with it.

Swiss Franc Stablecoin - Frankencoin (ZCHF)

Collateralized, oracle-free stablecoin that tracks the value of the Swiss franc.

Its strengths are its decentralization and its versatility.

Not dependent on external pricing sources.

Leverage on assets such as BTC, ETH and many more

Deposit collateral and take out a loan in Frankencoin (ZCHF) to laverage on your provided collateral.

In principle any collateral is possible with sufficient availability on the market.

The decentrally deployed smart contract allows anyone to create collateral positions or clone collateral positions at any time.

Invest in the future of the Frankencoin - FPS Token

Become an FPS (Frankencoin Pool Share) holder and participate in the success of the Frankencoin ecosystem.

Shareholders with at least 3% of the votes have veto rights.

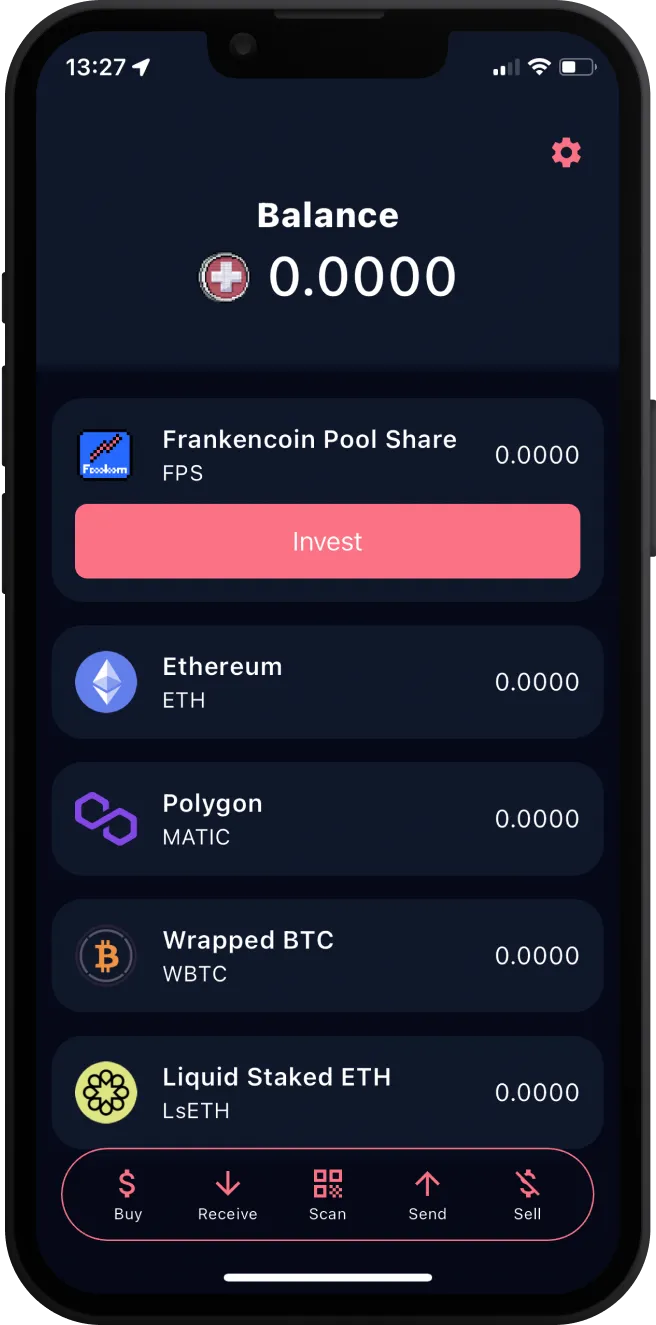

The Frankencoin Wallet.

Your Keys - Your Coins.

Frankencoin is a self-custody wallet, so you have control of the keys and access to your wallet.

Interact with the Frankencoin Smart Contract.

For example, exchange ZCHF for FPS (Frankencoin Pool Shares) or mint ZCHF by depositing e.g. ETH, participate in auctions and more.

DFX On- and Offramp.

Buy or sell ZCHF and FPS directly and conveniently via SEPA bank transactions or credit cards incl. Apple Pay and Google Pay.

Roadmap.

Apr 2024

Apr 2024

Apr 2024

Apr 2024

May 2024

Frankencoin Pay is available for testers to gain initial experience.

May 2024

Swap between FPS on Ethereum and WFPS directly in the app

May 2024

Swap almost any asset to any other asset such as WBTC to ZCHF using the DFX swap function.

May 2024

Use DFX to easily switch from, for example, ZCHF on Arbitrum to ZCHF on Polygon or directly to another asset on another blockchain.

Jul 2024

Exchange XCHF to ZCHF and vice versa.

Q&A

The primary objective of the Frankencoin is to establish a decentralized financial system that enables individuals to generate currency backed by collateral, akin to traditional banking practices. This initiative is driven by a commitment to transparency, decentralization, and inclusivity, aiming to empower users with the ability to mint their own Swiss Francs. By decentralizing the process of money creation, Frankencoin seeks to foster economic resilience and provide an alternative to conventional centralized financial frameworks.

Frankencoin sets itself apart from other stablecoins by employing an auction-based system for collateral determination, eliminating the need for external oracles. This approach prevents price manipulation by switching collateral assets during auctions, ensuring system integrity without relying on third-party sources. Additionally, its emphasis on collateral availability enables ongoing challengeability, while autonomous operation reduces owner intervention. Equity holders bear losses in case of insufficient auction proceeds, ensuring robust risk management within the system.

You can easily buy and sell Frankencoin (ZCHF) and other tokens with DFX.swiss' natively integrated FIAT On- and Off-ramp. You can buy with simple bank transactions or credit cards (VISA and Mastercard) as well as Apple Pay and Google Pay directly in your self-custody Frankencoin App.

FPS tokens represent ownership in the equity reserve pool of the Frankencoin system, functioning like shares in a bank. They enable holders to earn profits from system fees, participate in governance through voting rights, and provide liquidity by minting and redeeming tokens. FPS tokens play a crucial role in maintaining stability, governance, and value creation within the Frankencoin ecosystem. Read more here: https://docs.frankencoin.com/reserve/pool-shares#reserve-pool-shares

The Frankencoin project aims to democratize the creation of money by decentralizing the process through blockchain technology, allowing anyone with suitable collateral to participate directly in money creation.

The Frankencoin Pool Shares (FPS) represent a share in the equity capital of the system. The FPS holders get the profits (earned interests and fees) from the system, but are also covering the residual liquidation risk. Furthermore, FPS token holders accumulate voting power over time. Any FPS holder that has 2% of the votes - alone or together with others - can veto proposals.

Frankencoin offers a stablecoin pegged to the Swiss franc, preserving purchasing power and providing an alternative to existing stablecoin models. Additionally, it allows users to leverage assets like BTC and ETH to mine new Frankencoins or invest in the future of the project through FPS tokens.

Option 1:

Step 1: Download the Frankencoin App

Step 2: Click on deposit/buy

Step 3: Either choose FPS on ETH or WFPS on Polygon

Step 4: Pay via bank wire or credit card with Apple and Google Pay

Option 2:

Step 1: It’s possible to use the following website: https://frankencoin.dfx.swiss/

Step 2: Connect with Metamask

Step 3: Either choose FPS on ETH or WFPS on Polygon

Step 4: Pay via bank wire or credit card with Apple and Google Pay

Option 3:

Via Uniswap (ZCHF to FPS/FPS)

Option 4:

Polygon: Via Uniswap (ZCHF to WFPS)

Tip: Due to fees it might be better to use Polygon if the value is below USD 1k.

FPS are not locked. FPS can be transferred at any time. FPS can also be sold at any time. FPS can be exchanged for WFPS and sold via uniswap. All this is possible and there is no lock. If you want to destroy FPS with the SmartContract, these FPS must be at least 3 months old. However, this is not a sale but a destruction of the FPS. After that, these FPS no longer exist and the quantity in circulation of all FPS has decreased.

No, it neither qualifies formally nor functionally as a security. It does not qualify formally as a security under Swiss law as it does not represent a claim towards an issuer. Also, it does not qualify functionally as a security as it does not serve a financing purpose.

No, it neither qualifies formally nor functionally as a security. It does not qualify formally as a security under Swiss law as it does not represent a claim towards an issuer. Also, it does not qualify functionally as a security as it does not serve a financing purpose.

Yes, to some extent. The Frankencoin addresses issues within the current system of money creation, highlighting how it distorts capital allocation. For example, regulatory constraints may incentivize investments that aren't optimal for society. Traditional capital requirements tend to favor certain sectors like real estate and government bonds over others. By leveraging blockchain technology, Frankencoin offers an alternative outside the traditional financial system. It seeks to empower individuals by allowing them to create their own money, potentially leading to a stronger economy and more growth if used responsibly.